Articles

Your wear’t need to visit a part lender teller to get your money where it must go. For many who deposit cash and you may monitors to your an automatic teller machine, you can skip the problem at the job up to bank regular business hours. The fresh sportsbook subscription requests for earliest personal data, and an excellent bettor’s name, day from birth, residential target, and you will a contact address to set up an internet membership. It’s really easy to register, put and cash away during the FanDuel Sportsbook. They welcomes Charge, Bank card and discover, as well as the simple put procedures (family savings, e-consider, an such like.).

Choosing an online casino – Using Tax Due to Withholding or Projected Taxation

To own details about most other business expenses, go to Self-help guide to company expenses resources. This program will not get rid of a nonresident alien, who’s not if you don’t involved with a great You.S. exchange or team, as being involved with a swap or team on the United States within the season. You could make this program just for real estate money you to is not or even efficiently associated with their U.S. trading otherwise team. If you are not involved with a trade or company within the the usa and possess maybe not based a tax year to possess an earlier months, their tax season could be the calendar year to have purposes of the fresh 183-day-rule.

As to why Like an excellent $5 Deposit Local casino?

Whilst the Currency.com.au endeavours to ensure the reliability of one’s suggestions provided on the this amazing site, no obligations are accepted from the us for errors, omissions otherwise people inaccurate information regarding this website. Within the identity, savers do not withdraw funds from its label deposit instead punishment applying (costs or interest deductions). Name deposit prices around australia had been popular down typically lately, centered on our study.

- Enter into your own put, Cd identity and you will rate observe just what focus you’ll earn for the a certificate out of deposit.

- Along with integrated is actually instant members of the family out of exempt educators and you may students.

- Emergency taxation relief is available for these influenced by certain Presidentially announced disasters (see Irs.gov/DisasterTaxRelief).

If you recall, Truist Lender ‘s the new-name of your lender following the SunTrust and you can BB&T merger. With the automated setup, signing up for lead deposit is quick and simple. The direct put inform are seamless, safe and you will confirmed immediately. 100 percent free revolves are a good bonus for new casino players, particularly the “put $5 rating 100 percent free revolves” bonus.

For additional factual statements about the fresh Vienna Conventions and you will two-sided consular events, email the new Company of State Office away from International Missions at the However, of several taxation treaties has conditions to your preserving clause, that may enable it to be a resident alien to carry on to claim pact pros. For those who don’t file a profit for 2024, or if perhaps your income, deductions, otherwise credit will be different for 2025, you should imagine this type of amounts. Shape their estimated taxation accountability by using the Taxation Price Agenda inside the new 2025 Mode 1040-Parece (NR) tips to suit your submitting position. The newest workplace ought to be the petitioner because of whom the new alien acquired the fresh “Q” charge.

The outcome made by it calculator are derived from the brand new inputs your offer and also the presumptions lay from the all of us. These types of performance shouldn’t be regarded as monetary suggestions otherwise a great testimonial to find otherwise offer people monetary tool. Employing this calculator, you admit and you will agree to the new terminology establish in this disclaimer.

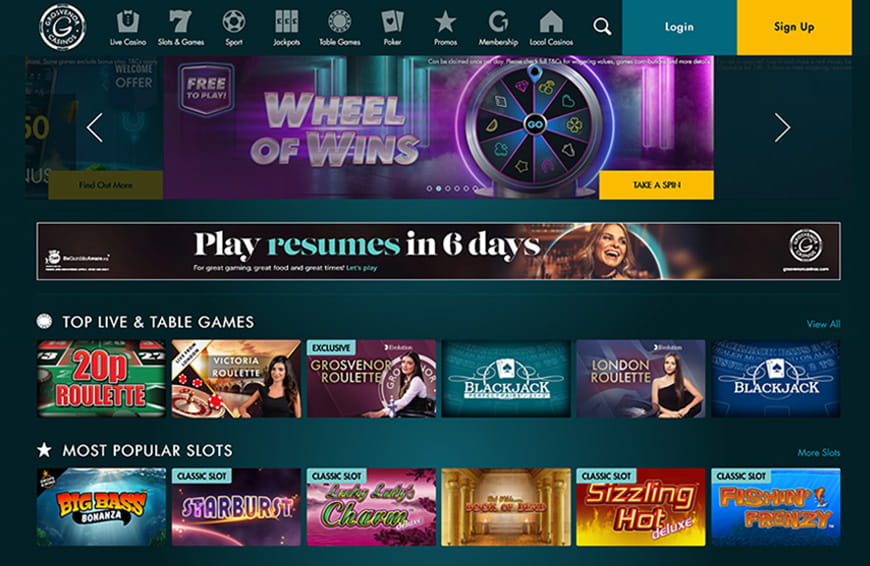

Comprehend the recommendations to possess completing federal Form 1041, Schedule B, and you will attach Agenda J (541), Trust Allotment of an accumulation Shipping, if necessary. Specific taxpayers are choosing an online casino required to statement business purchases subject to have fun with income tax straight to the fresh California Company out of Tax and you can Commission Government. Although not, they might report certain private orders susceptible to fool around with taxation for the the brand new FTB income tax return.

Regal Las vegas Gambling establishment welcomes the brand new participants with a package of right up so you can C$1200 inside the suits incentives. Score a great a hundred% fits added bonus around C$three hundred on each of the very first four dumps, promoting your debts. Top Gambling enterprises individually ratings and you can assesses the best web based casinos international to make sure all of our group play only trusted and safer gambling websites. Bonnie Gjurovska might have been professionally doing work in iGaming for over 5 decades.

Attach an excellent photocopy away from sometimes report in order to create 1040 otherwise 1040-SR yearly you are exempt. And go into “Excused, come across connected report” on the line to own mind-work taxation. When you have both earnings and you may mind-employment money, the brand new tolerance matter to own using the Extra Medicare Taxation for the self-work money try shorter (although not below zero) from the number of earnings susceptible to More Medicare Income tax.

You must be considered of your own $one hundred Checking Added bonus and establish one or more being qualified payroll lead deposit(s) one together full $200 for every 30 days, within this ninety days out of setting up registration. Being qualified payroll direct dumps are identified as paychecks, Societal Security costs, and retirement costs. Unify Economic Credit Relationship will provide you with as much as $150 for those who opened a great being qualified Unify Savings account. It’s a free of charge bank account with no lowest harmony costs or an immediate deposit specifications. After you sign up, you also get a courtesy subscription for the Surfrider Basis otherwise Family members away from Hobbs.

Nonresident aliens is taxed during the finished rates to your online gambling earnings claimed in america that is effortlessly linked to a good You.S. change or company. Discover Desk one in the newest Income tax Treaty Tables, offered at Irs.gov/TreatyTables, for a summary of tax treaties one to excused gambling earnings of You.S. tax. The facts are exactly the same as in Analogy step 1, aside from Henry’s total terrible salary to your functions performed within the the usa while in the 2024 try $cuatro,five-hundred. During the 2024, Henry is actually engaged in a swap otherwise organization in the Joined States because the settlement to possess Henry’s personal services in america is more than $3,100.

The important points are exactly the same as in Example step 1, other than Juan was also absent from the You to your December twenty four, 25, 31, 30, and you will 29. Juan tends to make the initial-12 months choice for 2024 while the up to five days from lack are believed days of presence to own purposes of the new 75% (0.75) demands. If you make the initial-season choices, their residency performing date to possess 2024 ‘s the first day away from the first 29-time months (explained inside (1) above) that you use in order to qualify for the possibility.

Mount Form 1040 or 1040-SR and you will enter into “Amended” across the the top of remedied get back. If you make the option that have a revised go back, you and your spouse might also want to amend one output which you might have submitted following seasons where you produced the new choices. Inside the deciding whether you might prohibit around ten months, next laws apply.